capital gains tax increase 2021 retroactive

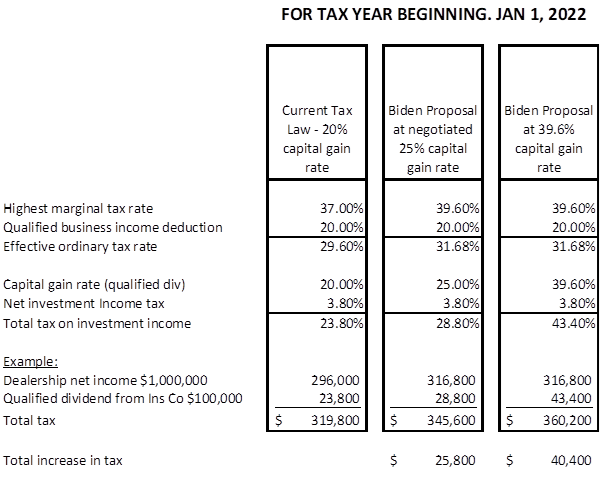

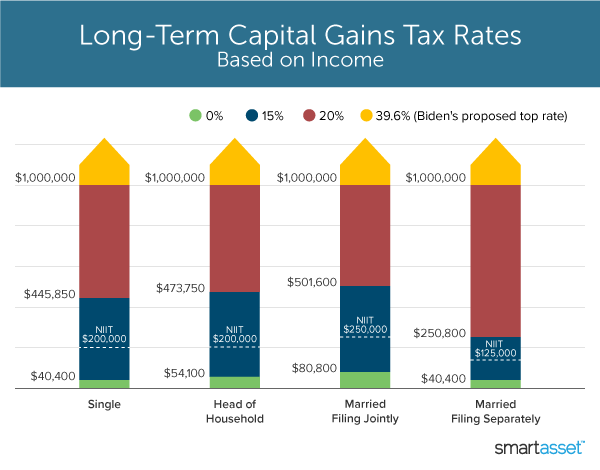

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year. If not retroactively then likely by January 1 2022.

Can Congress Really Increase Taxes Retroactively

Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax.

. The increase in revenue would come from the higher tax brackets thus forcing high-income taxpayers to shoulder additional tax liability. Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April. The purpose of President Bidens.

Heres how financial advisors are responding. Biden plans to increase this. Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike.

As MarketWatch points out the change primarily. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering. Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea. Will capital gains go up in 2021. Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds.

It appears that the White House is planning to make the. JD CPA PFS. Bidens Proposed Retroactive Capital Gains Tax Increase.

The maximum capital gains are taxed would also increase from 20 to 25. President Joe Biden is calling for a 396 top capital gains tax rate retroactive to the date of announcement. AUGUST 11 2021 BYJOE BISHOP-HENCHMAN.

Biden wants to tax capital gains you made even before a bill passes. It appears that the White House is planning to make the effective date. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

May 28 2021 637 pm ET. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a. A Retroactive Capital Gains Tax Increase.

A Retroactive Tax Increase. The 2022 Greenbook indicates that the proposed capital gains tax increase as part of the American Families Plan would be retroactive to late April 2021 the date of the Plans. This total tax is 2137200.

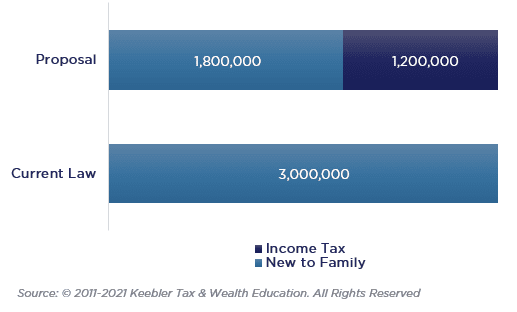

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Absent planning should all be taxed in 2021 the capital gains tax would be 3615000 500000 times 20 plus 9500000 times 37. Whats clear is that a capital gains tax hike is almost certainly on its way.

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive

Eye On The Estate Tax Nottingham Advisors

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

What S In Biden S Capital Gains Tax Plan Smartasset

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

State Income Tax Rates And Brackets 2022 Tax Foundation

A Retroactive Tax Increase Wsj

Planning For Biden S Proposed Tax Changes Coldstream Wealth Management

Retroactive Tax Legislation And Gift Planning In 2021 New Jersey Law Journal

Crystal Ball Gazing To The Past Article By Pearson Co

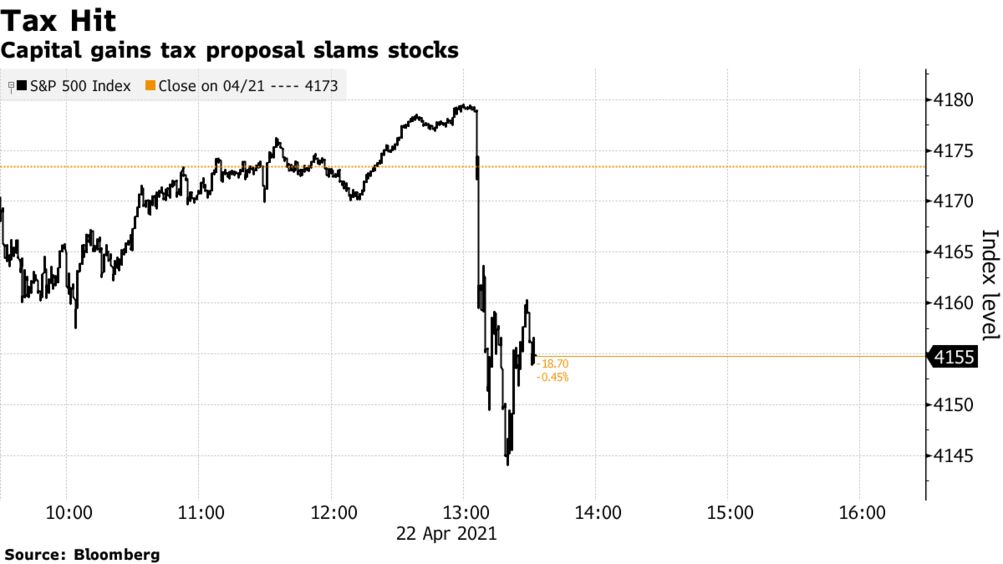

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg